What requirement should be included in Payslip Singapore?

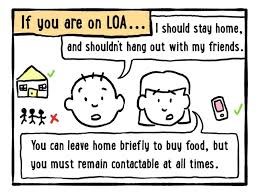

Issuance of Itemised Payslip and Key Employment Terms.

Simply complemented your payday has more sophisticated, regulated and complicated.

Government mandated that all itemized payslip include 12 required items.