New Interest Rates For CPF Singapore 2020

As you might know, leaving your cash in a bank account means that its value will get eroded over time, since bank account interest rates tend to be so pathetic that they probably can’t effectively hedge against inflation. The money in your CPF accounts earns interest, too, but thankfully at much better rates than your typical bank account. At the moment, the interest rates are as follows:

| Account name | Current interest rate |

| Ordinary Account | 2.5% |

| Special Account | 4% |

| Medisave Account | 4% |

| Retirement Account | 4% |

As you can see, your SA offers a much higher interest rate than the OA. There is one way to get a much better interest rate on your OA savings, and that is to transfer money from your OA into your SA. The catch, obviously, is that once your money goes into your SA, there is no going back. You can’t transfer it back into your OA, and as you can’t use the money in your SA to buy property or pay for education, the chief purpose of that money can only be for retirement.

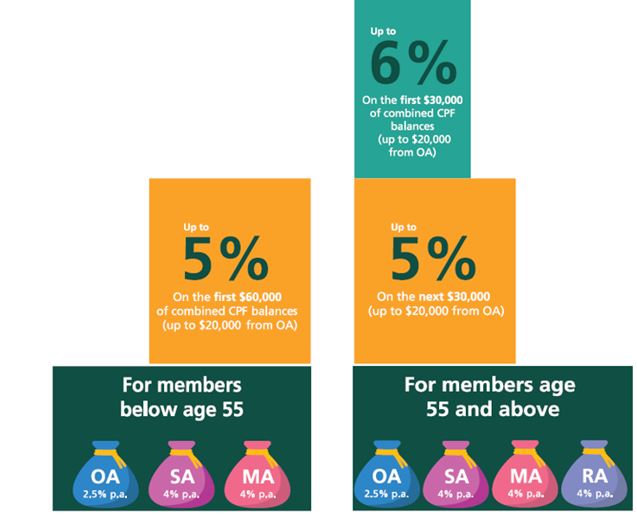

So before making any transfers from OA to SA, make sure you absolutely do not need the money for housing or education. You can also earn an extra 1% interest on the first $60,000 of your account balances (with up to $20,000 from your OA). If you are aged 55 and above, you can earn an additional 1% interest on the first $30,000 of your account balance (with up to $20,000 from your OA). This is basically to encourage you to keep your money in your CPF account, and to maximise it by leaving it in your SA or RA.

Just in case you’re thinking of gaming your CPF contribution and earning loads of interest, note that there is an Annual Limit to how much you can contribute. The maximum CPF contribution is known as the Annual Limit, and is currently set at $37,740.

CPF Interest Rates (01 July 2020 to 30 September 2020)

To enhance the retirement savings of Singaporeans, the Government pays extra interest on the first $60,000 of your combined balances (capped at $20,000 for Ordinary Account (OA)). Please refer to the details on extra interest in the table below.

| Age | Extra interest (capped at $20,000 for OA) |

| Below 55 years old | 1% per annum on the first $60,000 |

| 55 years old and above | 2% per annum on the first $30,000, 1% per annum on the next $30,000 This means that you earn up to 6% on your retirement savings. |

Extra interest earned on OA savings go into your Special Account (SA) or Retirement Account (RA) to enhance your retirement savings. If you are participating in the CPF LIFE scheme, the extra interest will still be earned on your combined balances, including the savings used for CPF LIFE.

Interest Rate for Ordinary Account

The interest rate on Ordinary Account (OA) monies is reviewed quarterly. OA monies earn either the legislated minimum interest of 2.5% per annum, or the 3-month average of major local banks’ interest rates, whichever is higher.

The OA interest rate will be maintained at 2.5% per annum from 1 July 2020 to 30 September 2020, as the computed rate of 0.64% is lower than the legislated minimum interest rate.

Interest Rate for Special and MediSave Account

The interest rate on Special and MediSave Account (SMA) monies is reviewed quarterly. SMA monies earn either the current floor interest rate of 4% per annum or the 12-month average yield of 10-year Singapore Government Securities (10YSGS) plus 1%, whichever is higher. In view of the continuing low interest rate environment, the Government has decided to further extend the 4% floor rate for interest earned on all SMA monies for another year until 31 December 2020.

Consequently, the SMA interest rate will be maintained at 4% per annum from 1 July 2020 to 30 September 2020, as the computed rate of 2.71% is lower than the current floor interest rate of 4% per annum.

Interest Rate for Retirement Account

The interest rate on Retirement Account (RA) monies is reviewed annually. RA monies credited each year will be invested in newly-issued Special Singapore Government Securities (SSGS) which will earn a fixed coupon rate equal to either the 12-month average yield of the 10YSGS plus 1% computed for the year, or the current floor rate of 4% per annum, whichever is higher. The interest rate earned by RA monies is the weighted average interest rate of the entire portfolio of these SSGS, which is adjusted in January each year to take into account the coupon rates payable by the new SSGS issuance. In view of the continuing low interest rate environment, the Government has decided to further extend the 4% floor rate for interest earned on the RA for another year until 31 December 2020.

The average yield of the 10YSGS plus 1% from November 2018 to October 2019 is 3.05% per annum. As this is below the current floor rate of 4% per annum, new SSGS issued in the year of 2020 will pay a fixed coupon of 4%.

Consequently, the RA interest rate from 1 January 2020 to 31 December 2020 will be maintained at 4% per annum.

How are the CPF interest rates computed?

Savings in the Ordinary Account (OA) earn either the legislated minimum 2.5%, or the 3-month average of major local banks’ interest rates, whichever is higher.

Savings in the Special Account and MediSave Accounts (SMA) are invested in Special Singapore Government Securities (SSGS) which currently earn either 4% per annum or the 12-month average yield of 10-year Singapore Government Securities (10YSGS) plus 1%, whichever is the higher, adjusted quarterly.

New Retirement Account (RA) savings are invested in SSGS which earns a fixed coupon equal to either the 12-month average yield of the 10YSGS plus 1% at the point of issuance, or 4%, whichever is the higher. The interest credited to the RA is based on the weighted average interest rate of the entire portfolio of these SSGS, and adjusted yearly.