Jobs Growth Incentives to Boost Hiring Local in Singapore

The Government has set aside $1 billion to support businesses to hire locals under the Jobs Growth Incentive (JGI) scheme. With the impact of COVID-19, there remains areas of strength in our economy and there are firms that continue to do well. The JGI provides substantial salary support to enable these firms to bring forward their hiring plans and grow their local workforce.

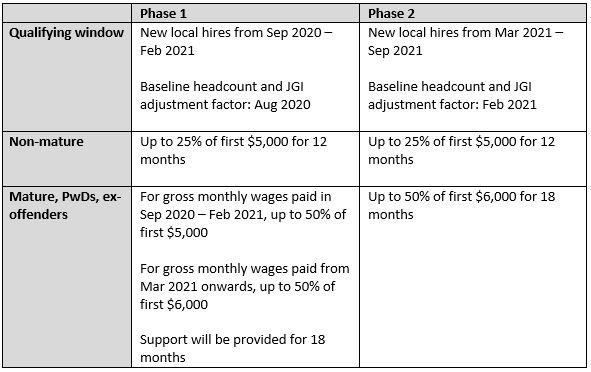

The Jobs Growth Incentives will provide up to 12 months of salary support for each non-mature local hire and 18 months of salary support for each mature hire, person with disability or ex-offender hired by employers that managed to increase their local workforce within the qualifying window.

What Is The Jobs Growth Incentive (JGI)?

Employers that increase their overall local workforce between September 2020 and September 2021 (inclusive) will receive Government support. The qualifying window for new local hires will be:

Phase 1 of the JGI: September 2020 to February 2021

Phase 2 of the JGI: March 2021 to September 2021

To be eligible for the Jobs Growth Incentive, there must be an increase in overall local workforce size and an increase in local workforce size earning ≥$1,400/month, compared to the August 2020 local workforce for Phase 1, or the February 2021 local workforce for Phase 2.

The support is 25% (or 50% for mature local hires aged 40 and above, persons with disabilities of the first $5,000 of gross monthly wages paid to all new local hires. The supportable gross monthly wages will be increased to the first $6,000 of gross monthly wages paid from March 2021 for mature local hires aged 40 and above.

Government support will be for up to 12 months for non-mature local hires from the month of hire and 18 months for mature, if employers continue to meet the eligibility criteria.

To encourage employers to retain their existing local employees as far as possible, the JGI payout will be adjusted downwards in the following circumstances:

if any existing local employees (in the employer’s employ as at August 2020) leave the employer after August 2020. This applies to local hires employed in Phase 1.

if any existing local employees (in the employer’s employ as at February 2021) leave the employer after February 2021. This applies to local hires employed in Phase 2.

The adjustment factor will be higher if more existing local employees leave the employer.

Jobs Growth Incentive (JGI) Adjustments

To encourage employers to retain local employees, the Jobs Growth Incentive payouts will be adjusted downwards if any existing local employees (in the employer’s employ as of August 2020) leave the employer after August 2020.

The adjustment factor is calculated based on the ratio of existing local employees who have left the employer to the total number of existing local employees as of August 2020, or 5%, whichever is higher. The adjustment factor is, therefore, higher if more existing local employees leave the employer. If the new local hires (employed from September 2020 onwards) leave the employer, this does not affect the adjustment factor. However, any JGI attached to such local hires will cease.

In other words, retaining your local employees (as of August 2020) is critical to receiving the full JGI payout. If any of your existing local employees leave, you will receive a lower JGI. This adjustment may affect smaller companies more as each existing local employee contributes a larger proportion of their existing baseline headcount.