What requirement should be included For Payslip Singapore?

Singapore only recently introduced the legal requirement to provide a written statement of pay with the Employment Act 2016. The law requires the payslip to be provided at the time of payment or, if this is not possible, within three working days of the payday. For leavers, the payslip must be provided with the residual salary payment. As far as the required content, the Singapore payslip is a comprehensive document that reflects accepted payroll best practice.

This created much dispute when the policy was first introduced. Many local SMEs, and human resource departments voiced out that such a mandatory law would drive up the already increasing manpower costs, effort and workload for HR teams, and ultimately be a significant expense issue for SMEs.

This delayed their implementation for 2 years to allow the companies to adapt. But now that the policy is fully in play, Singapore’s businesses have to care about it unquestionably.

When itemized payslip becomes important?

Issuance of Itemised Payslip and Key Employment Terms with effect from 1 April 2016

- Changes to the Employment Act (EA) requiring employers to issue itemised pay slips and key employment terms come into effect on 1 April 2016.

- The objectives of these changes are to:

- Improve employment standards; and

- Facilitate the resolution of any employment-related disputes, should these arise.

- For more details on the EA changes, please refer to Amendments to the Employment Act webpage.

- Employers can tap on the assistance package for the following:

- Blank payslips and KETs that can be filled in by hand.

- Software for generating itemised pay slips.

- One-to-one assistance for SMEs.

- Funding.

- As announced in August 2015, MOM will adopt a light-touch enforcement approach and focus on educating employers in the first year.

After that issue HRMS try to find template for payslip. From that we produce a payslip template in Singapore.

Items Requires to be Included in Payslip.

| Item Description in Payslip |

| Full name of employer. |

| Full name of employee. |

| Date of payment (or dates, if the pay slips consolidates multiple payments). |

Basic salary: For hourly, daily or piece-rated workers, indicate all of the following: -Basic rate of pay, e.g. $X per hour. -Total number of hours or days worked or pieces produced. |

| Start and end date of salary period. |

Allowances paid for salary period, such as: -All fixed allowances, e.g. transport. -All ad-hoc allowances, e.g. one-off uniform allowance. |

Any other additional payment for each salary period, such as: -Bonuses -Rest day pay -Public holiday pay |

Deductions made for each salary period, such as: -All fixed deductions (e.g. employee’s CPF contribution). -All ad-hoc deductions (e.g. deductions for no-pay leave, absence from work). |

| Overtime hours worked. |

| Overtime pay. |

| Start and end date of overtime payment period (if different from item 5 start and end date of salary period). |

| Net salary paid in total. |

How exactly then does an itemized payslip benefit Singapore?

At its core, it is a policy that is designed to improve the overall welfare of Singaporeans, for both businesses and workers. For employees, itemized payslips provide security and assurance regarding their standard pay and employment perks. This ensures that workers do not get short-changed or be subject to irresponsible employers.

For employers, complying with this newly reformed Employment Act policy allows businesses to stay out of trouble and minimize employment implications with the MOM. More importantly, this reduces the problems of compensation disputes for employees, and related issues concerning benefits and privileged perks. When everything is mandated and clearly stated in black and white, the occurrence of unjustified complains filed by employees is minimized and responsibility on the employers end is upheld.

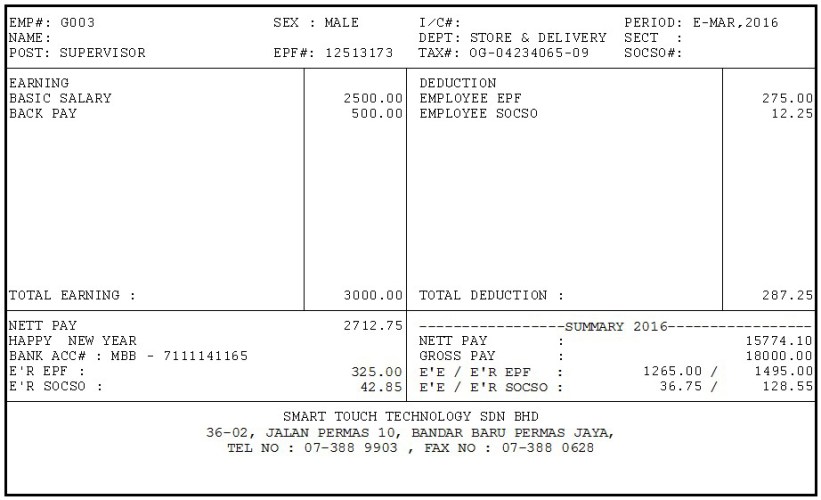

Example of Payslip Template

Important of Payslip in Singapore

It will decide whether or not you will pay income and other taxes. Your salary slip will also help fix how much money you will pay as taxes every year. In addition, you will know how much income tax returns you can claim from the government.

The salary slip also ensures access to certain services from the government that are given free or with heavy subsidy. This will include state-run medical care and cheaper food grains from public distribution system.

Further, bank credit, loans, housing mortgage and other borrowings you can avail is decided by the salary slip. Banks and lender institutions will definitely ask for copies of salary slip while applying for credit or loan. Pay slips help banks assess your creditworthiness and repayment capability.

A pay slip plays role of a bargaining chip when negotiating salary with a new employer. Large companies ask for copies of the last salary slip as proof of your earnings. It helps them decide how much to pay you.

Unfortunately, salary slips work sometimes against income earners facing divorce proceedings. For males, it will be used to decide how much alimony to pay. In the case of women, the alimony and compensation they get will be based on the husband’s salary slips.